Hydrogen

There are three types of hydrogen. Fossil (grey) hydrogen is a produced by the thermochemical conversion of fossil fuels (mostly natural gas) resulting in high CO2 emissions. Low-carbon (blue) hydrogen is produced like fossil hydrogen, except that the CO2 emissions are capture and stored. Renewable (green) hydrogen is produced from renewable electricity such as solar PV, wind, or hydropower. Among the three, fossil hydrogen is the most carbon intensive option and currently constitutes >95% of all produced hydrogen in Europe. Green hydrogen, on the contrary, produces zero carbon emission throughout its lifecycle (when excluding scope 3 emissions).

Why hydrogen

A zero-emission gas

Unlike fossil fuels, hydrogen does not emit greenhouse gases (GHG), and no air pollution occurs when it is used. Hence, it offers a solution to decarbonise industrial processes and economic sectors where reducing GHG emissions is both urgent and hard to achieve. All this makes hydrogen essential to support the EU’s commitment to reach climate neutrality by 2050 and the global effort to implement the Paris Agreement.

Decarbonising multiple sectors as both a feedstock and a fuel

Industry accounts for more than a quarter of the EU’s energy consumption. [1] Decarbonising industry is a challenge, particularly feedstocks[2] (e.g., for the production of fertiliser) and high temperature processes. Renewable or low-carbon hydrogen can substitute the existing use of fossil hydrogen, work as reducing agent for steel production, and provide industrial heat at high temperatures.

Long distance aviation and maritime shipping requires fuels with a high energy density, meaning that direct use of electricity from batteries, which have a comparably low energy density, is less suitable. For example, to power a cargo ship by electricity, it needs to carry a battery that is 1.6bn pounds, [3] heavier than the ship could load.

Buildings are responsible for approximately 40% of EU energy consumption and around 63% of household energy is used for space heating. [4],[5] Using hydrogen in hybrid heat pumps, combining electricity and gas, can significantly reduce the energy consumption for buildings with an already existing gas connection. The deployment of hybrid heat pumps has the potential to save up to €61 billion per year in the building sector. [6]

Figure 1. Final energy consumption by sector, EU, 2020 [6]

Decarbonising multiple sectors as both a feedstock and a fuel

Besides the potential climate benefits and wide applications across sectors, another advantage of hydrogen is its storability. Hydrogen can balance fluctuating electricity supply and demand, enabling high shares of intermittent renewable energies. Hydrogen can also provide inter-seasonal energy storage, both of which are needed in a net-zero energy system.

The capability of transforming renewable electricity into a storable energy source makes hydrogen one of the prime candidates to facilitate sector coupling. Sector coupling refers to the strategy to connect and integrate the energy flow between energy consuming sectors – building, transport, and industry – with the power producing sector. Due to the storability, hydrogen creates flexibility to decarbonise industry sectors and the energy system in a more cost-effective way. [7],[8]

Figure 2. Sector coupling

Insights

Today, more than 95% of hydrogen is produced from fossil fuels

The current production of hydrogen results in 70 to 100 Mt of GHG emissions in the EU.[9] If this hydrogen would be produced with renewable electricity, direct GHG emissions would be zero while applying carbon capture to produce low-carbon hydrogen can reduce GHG emissions by 60-90%.

Figure 2. Hydrogen production costs

20 Mt renewable hydrogen production and import by 2030

The European Commission’s REPowerEU plan has set the ambition produce 10 Mt (333 TWh, LHV) renewable hydrogen domestically and import another 10 Mt, achieving a total supply of 20Mt (666 TWh) by 2030.[10],[11]

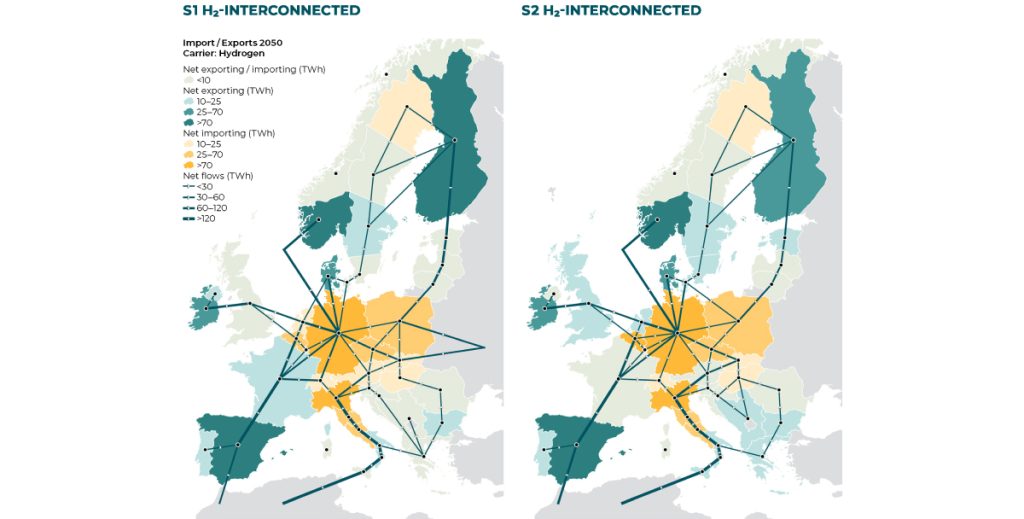

Domestic hydrogen supply potential is vast and could exceed projected European demand

If the REPowerEU targets are achieved, the supply of renewable hydrogen by 2030 could be almost double of the current (fossil) hydrogen consumption (339 TWh). [12] To achieve this goal, a pan-European hydrogen transmission network allowing to access vast amounts of hydrogen produced in regions where it is cheapest, is essential.

Key actions

Pan-European hydrogen transmission network must be developed

An interconnected European hydrogen pipeline can connect demand clusters and regions with high renewable energy supply potentials in a cost-efficient way, requiring around 145 GW of cross-border transmission capacity in 2030 already.[13] The European Hydrogen Backbone (EHB) initiative envisioned a pan-European hydrogen transmission system utilising existing gas infrastructures across 28 countries to create 5 Hydrogen Corridors. Repurposing the existing gas infrastructure to transport hydrogen saves costs. The costs for repurposing are estimated to be 10%-35% of a newly constructed hydrogen pipeline. [14] The combination of these pan-European hydrogen corridors can effectively accelerate the decarbonisation of our energy system while increasing energy security in the EU, resulting in a 10% decrease of GHG emissions over the timeframe 2030-2050 compared to scenarios without a pan-European hydrogen network. [15]

Low-carbon hydrogen as a transitional option to scale up the market for renewable hydrogen

Low-carbon hydrogen can be a scalable and cost-effective option to drive emission reductions and accelerate the pace of the transition. Especially in the market’s ramp-up phase before 2030, when renewable hydrogen is expensive and supply potential from dedicated renewables alone will be insufficient to meet local and regional demand in absence of a fully interconnected European hydrogen backbone.

Report

Assessing the benefits of a pan-European hydrogen transmission network

De-risk investment for production and import

Without long-term offtake contracts, it will be difficult to make investment in hydrogen production bankable in potential export regions. There are multiple funding mechanisms on EU level are being announced. For domestic production, the European Hydrogen Bank will invest over €3 billion in building up the domestic hydrogen market. [16] For hydrogen imports, the REPowerEU highlighted the role of the Connecting Europe Facility – Energy (CEF-E) and the Recovery and Resilience Facility (RRF) in facilitating and securing available funds for hydrogen imports projects. In addition, InvestEU also provides a potential funding option for hydrogen imports.

Develop and remunerate of underground hydrogen storage capacities

Large-scale hydrogen storage will be a core component of the hydrogen network and integrated European energy system, with around 90 TWh required in 2030.[17] As the lead times to develop underground hydrogen storage are long (3-10 years), [18] there is an urgent need to estimate the storage capacity requirements across the integrated hydrogen network and start with concrete plans and developments.

Furthermore, there is a need to develop a financing and remuneration model for hydrogen storage. Until the financing and remuneration model is developed, it is unlikely that greenfield development or repurposing of existing natural gas storage assets will take place on the scale required as the incentives are lacking.

Report

Facilitating hydrogen imports from non-EU countries

International partnerships to balance hydrogen supply and demand

Neighbouring regions have significant hydrogen supply potential at competitive costs, which can become available to consumers through the European Hydrogen Backbone. By 2040, with expected levelised costs of green hydrogen production of 1.0-2.0 €/kg for onshore wind and solar PV, producers in Ukraine and North Africa could benefit from a mature backbone at levelised transport costs of 0.2-0.5 €/kg. This makes green hydrogen imports of 1.5-2.5 €/kg an attractive complement to domestic supply options in parts of Europe – especially considering more challenging conditions around land availability and public acceptance of renewables in European countries. [19]