Biomethane

Biomethane is a purified form of raw biogas that is derived from organic matters. Biomethane is an energy dense, storable, and flexible energy source with a high greenhouse gas saving potential and the ability to generate negative emissions. With a chemical property close to methane, biomethane can be transported through existing gas infrastructure and can be used with existing end-use technologies.

Biomethane

There are two main technologies to produce biomethane. Anaerobic digestion can process a diverse range of biogenic feedstocks, including manure, sequential crops [1], energy crops [2], agricultural waste and residues, industrial food and beverage waste, sewage sludge and the organic fraction of municipal solid waste such as food waste. Gasification on the other hand can more readily process feedstocks with low anaerobic biodegradability, such as sustainable woody biomass (e.g. forestry residues, post-consumer waste wood), agricultural residues, municipal solid waste [3] and liquid organic waste streams (e.g. slurries).

Why biomethane

Biomethane is the cheapest and easiest to scale form of renewable gas available today

With mature technologies in production, transmission, and storage, biomethane can be readily deployed across the whole energy system using existing gas infrastructure. Production costs for biomethane range from €50-€110/MWh depending on the feedstock, technology, and plant scale [4], which is competitive against current natural gas prices.

Figure 1. Natural gas price development since 2021 [5] and LCOE of biomethane [6], [7]

Besides, biomethane finds use across the economy to decarbonise hard-to-abate sectors. For industry, biomethane generates high temperature heat that cannot easily be electrified. It also provides biogenic carbon feedstock for food industry (to freeze, chill or pack food), beverage carbonation, metal fabrication, fire suppression and stimulating plant growth in greenhouses. For transport, biomethane can power long distance heavy transport that requires high energy density fuel. For buildings, biomethane can heat buildings with existing gas connections through hybrid heat pumps. Moreover, in power sector, biomethane can balance the grid with storable and dispatchable energy.

Achieving 80%- 200% emission reduction when biomethane replaces fossil fuels

In addition to the emissions avoided from replacing a fossil fuel, a similar amount of greenhouse gases either is effectively removed from the atmosphere (and stored in the land) or is avoided in adjacent systems. In the anticipated large-scale deployment of biomethane to 350 TWh by 2030, the average lifecycle emissions are expected to be slightly below zero, due to a combination of avoiding emissions from alternative waste treatment, soil carbon accumulation, using digestate to replace fossil fertiliser, applying carbon capture and storage or replacement.[8]

Compared to a fossil fuel comparator of between 75 and 95 g CO2eq/MJ [9], the total savings will be about 100 g CO2eq/MJ. This means that about 110 Mtonne CO2eq of emissions could be avoided by sustainable production and use of biomethane. [10]

Significant economic and social benefits

The restarting of the global economy in 2021 following the covid-19 pandemic resulted in a rapid increase in natural gas. To compound this, the Russian invasion of Ukraine has created significant uncertainty on the future of energy imports to Europe from Russia. Biomethane can directly replace natural gas, or otherwise serve as a substitute for other fossil fuels depending on the end-use application. As locally produced biomethane reduces the need to import natural gas, it can directly improve Europe’s energy independence and security, and cushion against exposure to volatile natural gas prices.

During the purification process to produce biomethane from biogas, biogenic CO2 is separated and captured from the stream. As CO2 used today is mainly fossil-based, biogenic CO2 could provide a sustainable alternative and importantly generate an additional income stream for biomethane producers. For example, in Denmark, biomethane producer Nature Energy is capturing 16 kt CO2/year at its Korskro plant. This is equivalent to 25% of the annual demand for CO2 in Denmark and is primarily used in the food and beverage industry. [11]

The ramp up of biomethane production supports stable job creation across the value chain, including project development, construction, feedstock supply, and operation and management. In total, the biomethane industry could create 280,000-490,000 jobs in 2030 and up to 1,130,000-1,810,000 jobs in 2050. Benefit to European economy that could be realized by new jobs created in the biomethane industry in 2050 valued at €51-82 billion. [12]

Report

The future role of biomethane

Insights

We can meet REPowerEU biomethane production target

Today, 3 bcm of biomethane and 15 bcm of biogas are produced in the EU-27. Our estimation shows that up to 41 bcm of biomethane could be available to meet the REPowerEU 2030 target of 35 bcm. [13]

Towards 2030, more than 90% of biomethane will be produced via anaerobic digestion of waste and residual biomass from agriculture, the food industry and municipal waste. [14] Beyond 2030, other technologies such as thermal gasification will help to further increase the potential, to achieve over 1,000 TWh per year by 2050, which would be a substantial share of the future gas mix. [15] , [16]

Figure 2. EU biomethane potential (bcm/year)

Significant increase of potential from 2030 to 2050

At a European level, there is significant potential to scale up the production of sustainable biomethane in the coming decades. If the supporting action and policy are deployed, biomethane production potential can increase from 41 bcm in 2030 to 151 bcm in 2050. [17]

Even more biomethane potential can be unlocked by looking at additional feedstocks (e.g. biomass from marginal or contaminated land and seaweed, as noted in the REPowerEU plan [18] ), and technologies (e.g. hydrothermal gasification of wet feedstocks, including organic wastes and residues). Renewable methane (or power to methane), produced from renewable electricity and biogenic CO2 captured in biogas upgrading can furthermore contribute additional potential, as can landfill gas.

Figure 3. 2030 and 2050 National biomethane potetional (bcm/year)

Key actions

Mobilise sustainable feedstock supply chains to scale-up biomethane production

Mobilising available volumes of waste and residue feedstocks including manure, agricultural residues, food waste, and industrial wastewater, can be the first step. These feedstocks are the cheapest and offer the highest GHG emissions savings. The European Commission should set out a clear and sustainable approach to using crops for biomethane. This approach should include implementing guidance and appropriate definitions for the use of sequential cropping as part of sustainable farming practices.

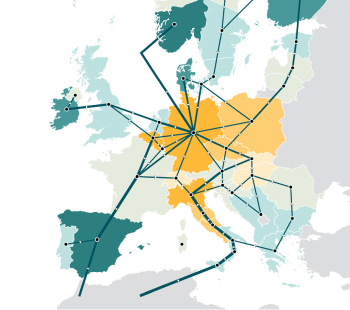

Facilitate biomethane integration into the gas grid infrastructure

A scale-up of biomethane from 3 bcm to 35 bcm by 2030 requires significant integration into the gas grid infrastructure. Recommended schemes to facilitate the integration includes updating the quality standard for cross-border gas, identifying projects to pool multiple sources of biogas to a central upgrading biomethane plant, minimising connection and grid integration costs, and implementing regional mapping (zoning) of potential biomethane production in all Member States.

Develop and implement national biomethane strategies

Following the biomethane ambition set by the EU, the REPowerEU 35 bcm target needs to be translated by the Member States into national targets, incorporated into their National Climate and Energy Plans and appropriate measures (e.g. permitting, financing, certification, etc) enacted to scale up their domestic biomethane industries.

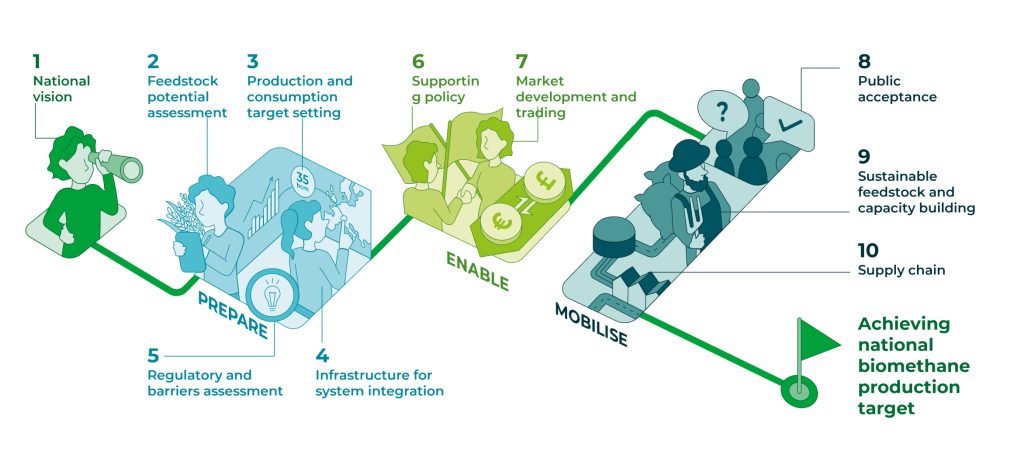

Gas for Climate has compiled a step-by-step manual to support member state achieve national biomethane potential. The manual details each actions from developing a national vision on biomethane and setting initial targets to having a fully implemented national biomethane strategy. Because Member states are at different stages in their biomethane journeys, the core focus of this manual is to be as practical as possible – ideally, it serves as a “checklist” that key stakeholders in all member states can use in the development and implementation of their national strategies.

Report

Manual for national biomethane strategies

Figure 4. Ten steps to build a national biomethane strategy